CFC #012 - The Honest Mistake That Hurts Your Cash Flow

Jul 29, 2023

"Cash is king."

As a business owner, you’re likely familiar with this phrase.

It’s used so often its meaning seems obvious.

But feeling like we know something and acting on that feeling are two different things.

In over 15 years of working with business owners, I've found that many rely on their current bank balance and gut feeling of cash needs to manage their business’s cash flow.

This can lead to unexpected cash shortfalls and missed opportunities for financial success.

Today, I want to reveal a simple tool you can use to take control of your business’s cash flow and unlock the power of better financial decisions in your business.

But first, I need to clarify why relying solely on your bank balance and your gut to manage your cash flow is a big mistake.

Let's get started!

Your Bank Balance and Gut Feeling: An Incomplete Picture

Your bank balance shows a snapshot of your business’s financial status at a given point in time.

But it doesn't show you what’s to come (e.g. pending payments, incoming invoices) or what could come (e.g. future investments, hiring impacts, etc.).

Many business owners try to bridge this gap with their general sense of what may come.

But, as a busy person and business owner you’ve got a lot on your mind.

So, it’s really easy to accidentally miss something.

That’s why relying on just your bank balance and gut feeling to manage your cash flow can lead to:

- Cash Shortfalls: If you have upcoming expenses or pending payments not reflected in your bank balance, you may find yourself short on cash when these payments are due.

- Missed Opportunities: Without visibility into future cash inflows, you might miss out on potential investment opportunities or be unable to take advantage of favorable market conditions.

- Reactive Decision Making: Without forward-looking insights, your decisions become reactive instead of proactive, limiting your ability to steer your business towards desired financial goals.

The Hidden Power of Cash Flow Forecasting

Cash flow forecasting is a critical financial tool that provides an estimated projection of how money will flow in and out of your business in the future. It can empower you to:

- Anticipate Future Needs: Cash flow forecasting allows you to see potential cash shortfalls or surpluses before they happen. This means you can make necessary adjustments in advance, ensuring smooth financial operations.

- Make Informed Decisions: By providing a glimpse into future financial scenarios, cash flow forecasts equip you with the data to make informed strategic decisions - from managing expenses to capitalizing on investment opportunities.

- Secure Financing: A robust cash flow forecast can help persuade lenders and investors of the financial viability of your business, making it easier to secure loans or attract investment.

- Mitigate Risks: Cash flow forecasting can help identify financial risks before they turn into significant problems, allowing you to devise strategies to mitigate these risks.

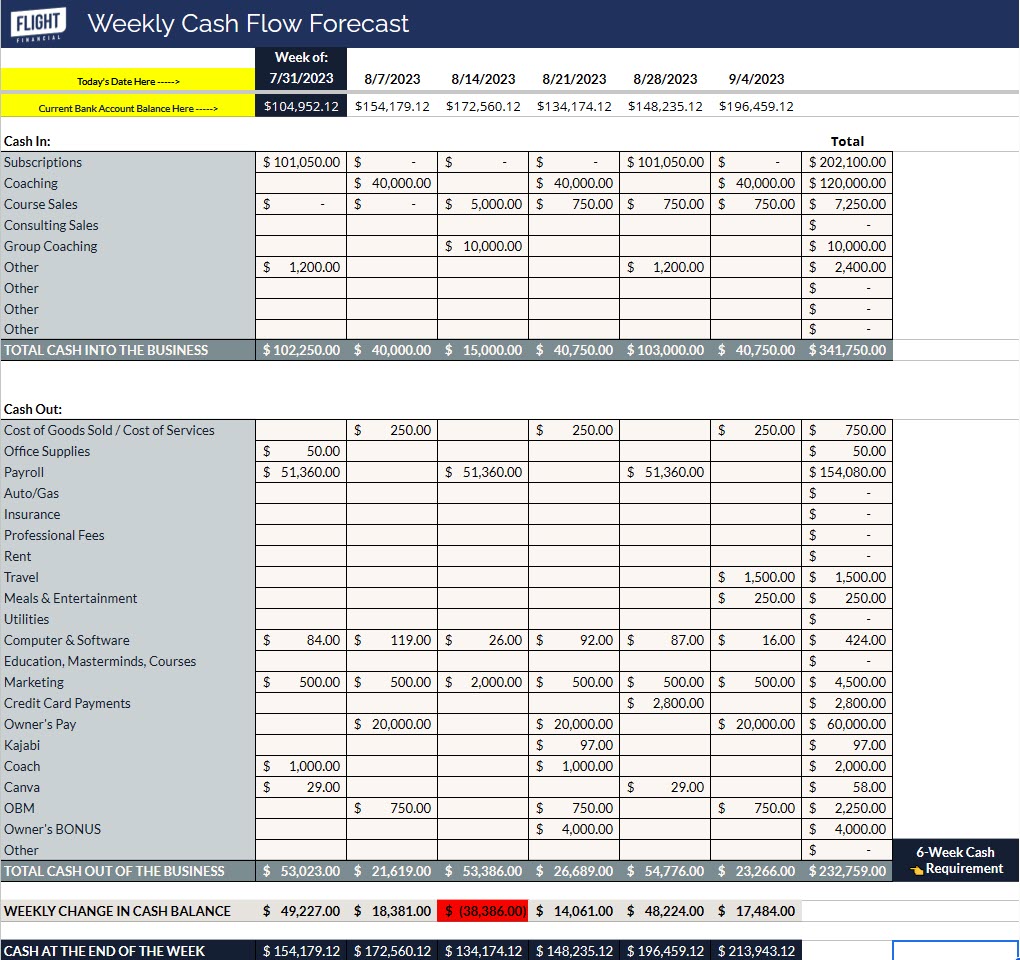

Below is a snapshot of what a simple weekly cash flow forecast looks like.

This snapshot shows the cash coming in and out each week, the weekly change in total cash, and the ending cash balance.

This tool provides an easy way to model the cash flow impact of potential decisions or situations.

For example, say you want to hire an online business manager (OBM) to take some mental load and administrative work off of your plate.

You can see what impact that cost will have on your anticipated cash flow and decide whether or not your business can afford that additional resource and at what cost.

Want an easier way to manage your cash flow?

A fractional CFO brings in a wealth of expertise to help you harness the power of cash flow forecasting. They can:

- Assist in setting up accurate and detailed cash flow forecasts.

- Provide strategic advice based on forecast data to guide your financial decisions.

- Regularly review and adjust your cash flow forecasts to align with changing business conditions and goals.

I’ve personally been helping business owners like you make the most of their business’s cash and financial performance for more than 15 years.

What’s next?

Ready to step beyond bank balances and gut feelings and embrace the power of cash flow forecasting for more effective decision making?

Want some help getting started?

Book a free strategy session here.

We’ll discuss where you’re at, where you want to be, and whether a fractional CFO makes sense for you right now.

In the meantime, stay tuned for more actionable insights and strategies that can bolster your business's financial health and lower your stress.

Until next time!

In the meantime, if you’re looking for more, there’s a couple ways I can help you:

- Watch my free on-demand training on my 5-step system you can use to get the financial results you want from your business and feel less overwhelmed. Free training here.

- I can help free you from financial stress in your $1M+ services business and discover a faster route to the results you need for the life you want. Book a call here.